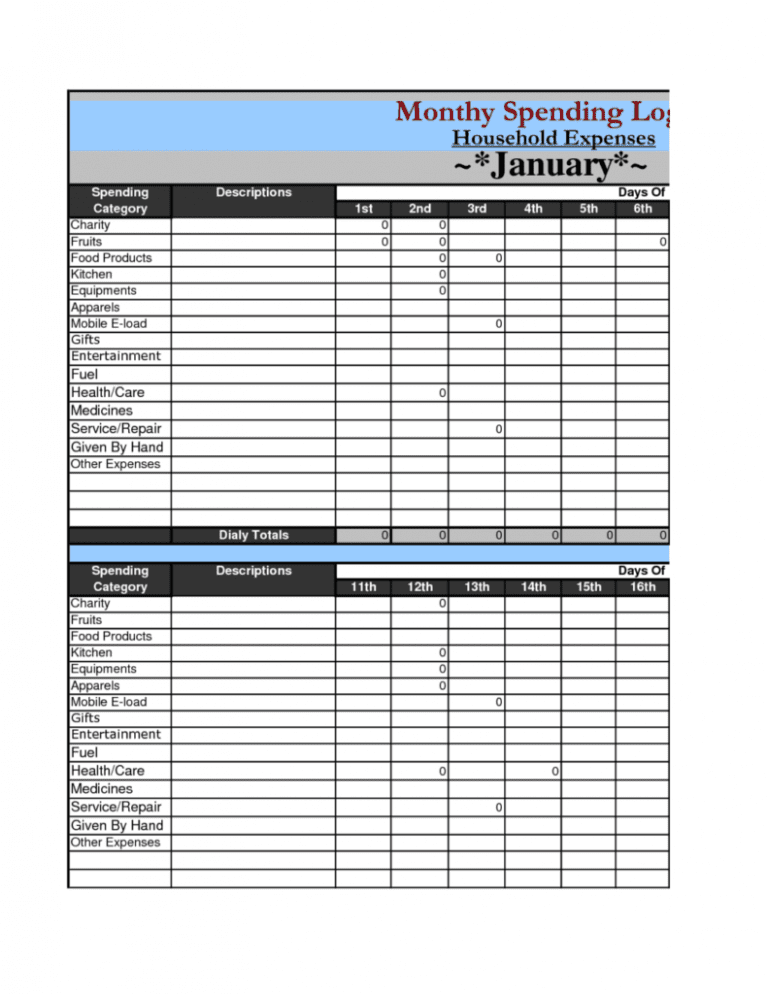

Include $103 every month as your car insurance expense in your monthly budget. To figure expense as a monthly amount take $620 and divide by 6. You pay $620 every six months for car insurance. Stash that money an account separate from the account you use daily, so you’re not tempted to use it! Include $35 as your monthly holiday expense in your monthly budget. To figure the expense as a monthly amount take $420 and divide by 12 (the number of months in a year): This year you want to have that money before the holiday season begins. You purchased things like gifts, wrapping supplies, decorations and food for parties. Sample Budget for a College Student Tuition and Fees, 1,111, 5,000 Rent/Housing, 500, 2,250 Utilities, 200, 900 Cable/Internet, 35, 158. Last December you spent about $420 on holiday spending. Once you have identified your periodic expenses, break them into monthly amounts. How do I incorporate them into my monthly budget? Travel expenses (to visit family, attend events, vacation).Deposits for rental housing (if a move is in your future).

The information is provided by CMHC for general illustrative purposes only, and does not take into account the specific objectives, circumstances and individual needs of the reader.

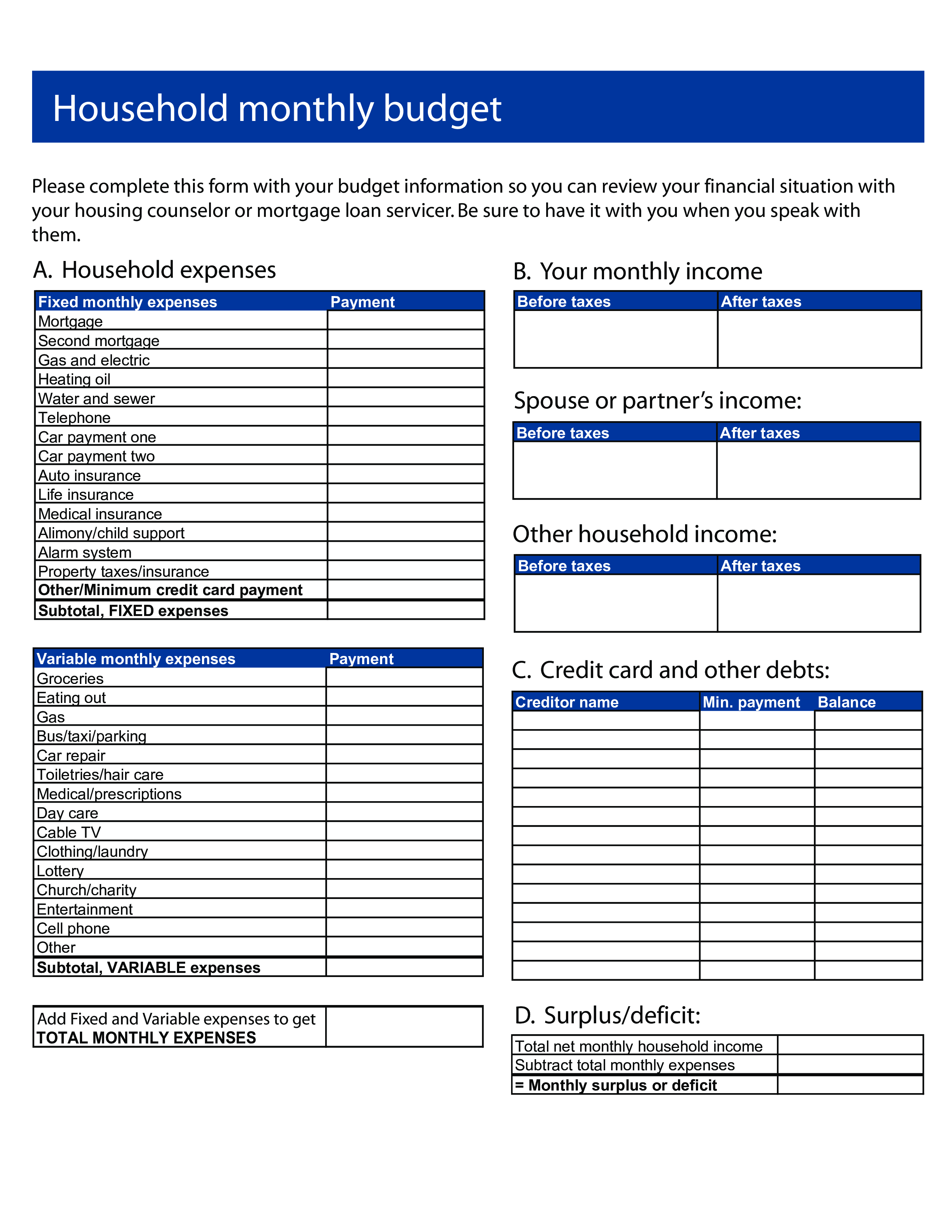

#EXAMPLES OF MONTHLY EXPENSES PROFESSIONAL#

Ask your mortgage professional about CMHC. CMHC is Canada's largest provider of mortgage loan insurance, helping Canadians buy a home with a minimum down payment starting at 5%. Make sure you add these other costs when you fill out this form.įor more homebuying tips, visit CMHC's interactive Step by Step Guide. Note: You may have other costs not shown on this worksheet. DetailsĮntertainment, eating out, recreation, moviesĭental expenses, medical expenses, prescriptions, eye wear You may have encountered a financial report, and would like to know what the difference is between a monthly. Use the following worksheet to help develop your budget. 10+ Monthly Financial Report Examples Government, Economic, Project Regardless if you are working for the government or a private sector, you are an employer, a project manager or even an employee, you are no stranger to a report. If you continue to spend more than you make, you must find ways to spend less. You should watch what you spend each month and see if you are getting closer to meeting your financial goals. Preparing a monthly budget - and sticking to it - is one of the keys to successful homeownership.

Homeowner Business Transformation (HBT).Homeowner and small rental mortgage loan insurance.Rental Construction Financing Initiative.National Housing Strategy Project Profiles.

0 kommentar(er)

0 kommentar(er)